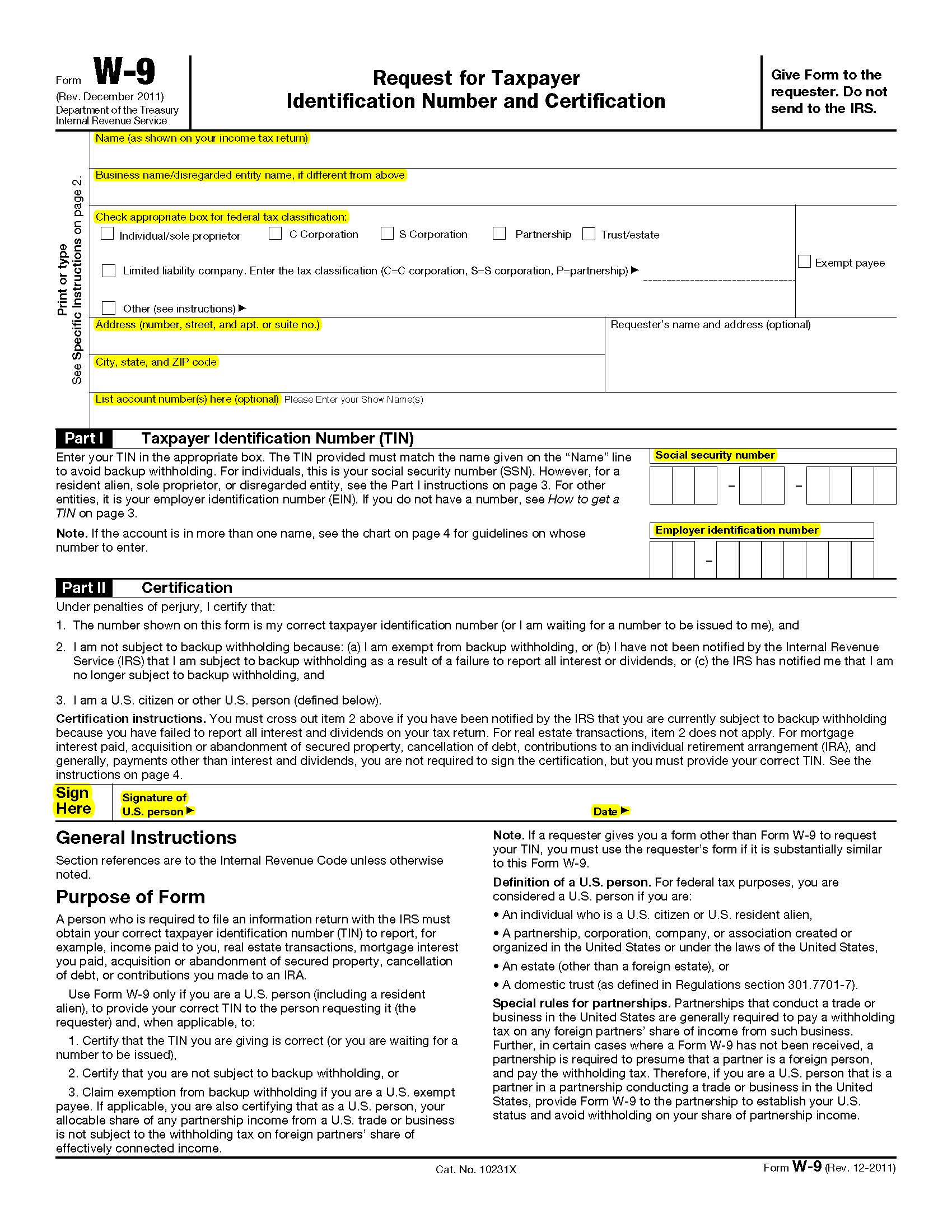

If you are involved in Advertising, MyLibsyn, a Smartphone App, or any other venture with Libsyn that allows you to monitize your show, Libsyn will require that you fill out a W-9 for tax purposes. We will explain what needs filled out for the W-9 below.

You can download the current W9 form from the IRS by clicking here.

Name (as shown on your income tax return)

Please legibly print your name as it appears on your income tax return.

Business Name

If you are a business, legibly print your legal business name.

Federal Tax Classification

Please check the box for the federal tax classification you or your business falls under. If you are unsure, please consult your accountant.

Address

Legibly print your street address (including any apartment or suite numbers), city, state, and zip code. Only abbreviate standard items such as APT (for apartment), DR (for drive), or your state abbreviation, do not add other non-standard abbreviations.

List Account Numbers

Legibly print your show name. If you have multiple shows, please list all applicable shows on this line.

Tax Identification Number (TIN)

If you are an individual, enter your Social Security Number. If you have an EIN (for a business), enter your EIN. Both are not needed but one is required.

Sign and Date

Make sure to sign AND legibly print your name on the signature line, then place the date on the end of the line.

NOTE: If all items are not filled out or properly filled out, a representative will request you fill out the form and resubmit. You will not get a payment for sales until a proper W-9 is submitted.

Have questions? Contact our billing team at billing@libsynsupport.com.

If you have a smartphone app please send your W9 to accounting@libsyn.com. If you reside outside the United States, please contact Greg Jakub, greg.jakub@libsyn.com, with your full name, company name, address, and e-mail address to discuss payment options.